Understanding API-driven payouts: a webinar overview

Article snapshot

Covering how businesses are using API-driven payouts to automate workflows at scale, key lessons from Fire’s latest webinar, and answers to common implementation and operational questions.

A practical look at automated payout workflows, real-world applications, and benefits.

–

Why API-driven payouts are relevant today

Efficient payment processing and disbursement are vital across industries, yet many organisations still rely on manual processes that are time-consuming, error-prone, and difficult to scale.

To help businesses see how automation can simplify payment operations, the Fire team hosted a webinar on 5 November. The session explored how organisations can manage payouts through a single API integration, reducing manual work while improving accuracy, control, and reconciliation.

The webinar forms part of Fire’s ongoing series designed to educate and share insights on payments. It highlighted practical applications of API-driven payouts, demonstrated the benefits for finance and operations teams, showcased Fire’s platform in action, and featured an interactive Q&A session with attendees.

What are API-driven payouts?

An Application Programming Interface (API) allows two systems to exchange data and trigger requests, removing the need for users to manually enter payment information or operate separate payment tools.

API-driven payouts enable businesses to automate their payment workflows by connecting their systems directly to a payment provider.

This automation helps businesses to:

- Reduce manual data entry

- Minimise operational errors

- Improve processing speed and timing

- Standardise reconciliation

- Scale payment volumes without additional overhead

APIs are widely used across digital services, powering embedded features like maps in taxi or delivery apps and facilitating e-commerce payments, often without users even noticing. However, their adoption in traditional banking is still limited, and industry awareness is gradually evolving. Fire’s API provides businesses with a direct and flexible way to integrate payment operations into their platforms, streamlining automation and simplifying overall integration.

From concept to execution: automated payouts in action

During the webinar, our team demonstrated how the Fire Payments API can streamline end-to-end payment processes. Attendees saw how practical features such as event-driven notifications, sub-accounts, batch payment automation, and configurable rules can work together to simplify everyday payment processes, speed up reconciliation, and provide better visibility across all transactions.

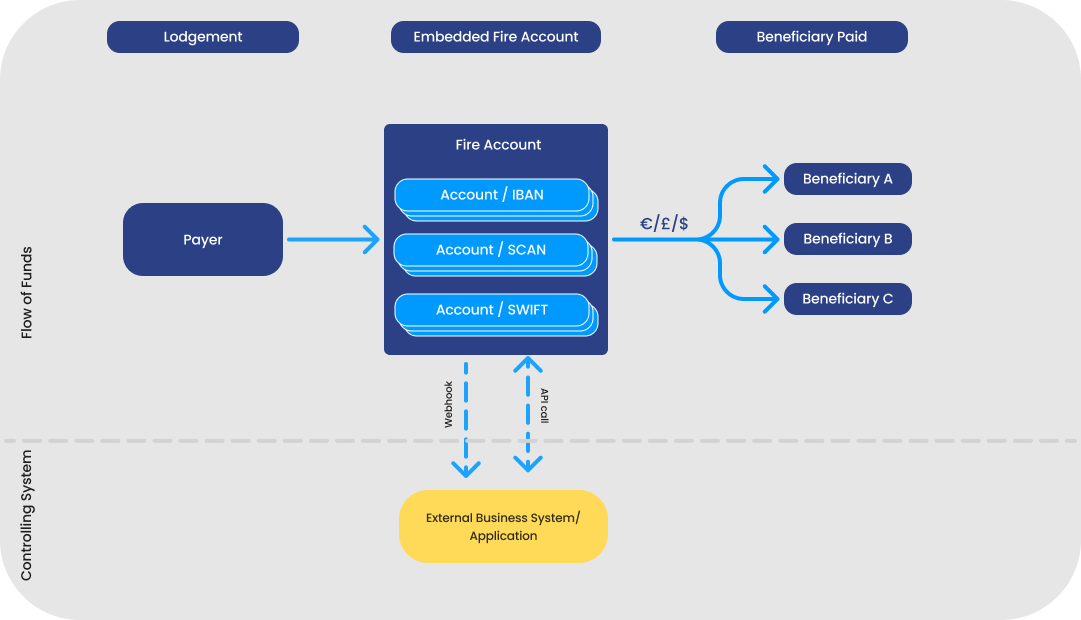

Webhooks for event-driven processes

Webhook notifications alert systems when activity occurs, such as lodgements, open banking payments, and card authorisations. These events can trigger workflows automatically, removing the need to manually monitor accounts.

Sub-accounts for reconciliation

Businesses can assign unique account details to customers, partners, staff, or suppliers, allowing settlement flows to be segregated and easier to match against internal records.

Batch automation

When funds are received, businesses can send a payment batch to Fire specifying how much should go to each recipient. Fire processes the batch automatically, reducing manual effort and speeding up settlement.

Configurable logic

Businesses can define rules to determine who to pay, when, and how much. These details are passed to the Fire Payments API and processed automatically, giving full flexibility while maintaining control.

Together, these capabilities help businesses reduce operational work, minimise error rates, and gain a clearer view of cash flow.

Value for different stakeholders

Payment automation delivers benefits across teams and business partners.

For management team and decision-makers

- Reduced operational overhead

- Cost efficiencies

- Improved payments oversight

- Scalable processes supporting growth

For finance and operations teams

- Less manual data entry

- Faster reconciliation

- Fewer payment errors

- More time for strategic tasks

For suppliers, contractors, and partners

- More accurate, timely payments

- Reduced administrative friction

- Increased trust

Use cases: how businesses are using API-driven payouts

At the webinar, we highlighted some of our key clients and shared practical examples of how these organisations have integrated with Fire to streamline their payment flows.

Fenero – simplifying payment workflows for contractors and umbrella companies

Fenero is a multi-award-winning tax, payroll, and accounting platform supporting contractors across Ireland. Processing over €250 million in payments annually across 200+ umbrella companies, Fenero integrated Fire’s Payments API to automate incoming and outgoing transactions. Webhooks provide real-time updates when funds are received, triggering automated disbursements for salaries, tax, VAT, and fees. This automation reduces manual effort, improves reconciliation, and ensures contractors are paid accurately and on time, while allowing Fenero to scale operations efficiently without increasing administrative overhead.

GoodBox – automating payouts to partners through full API integration

GoodBox provides fundraising technology for charities in an increasingly cashless society. Previously, payouts to charity partners were processed manually, a time-consuming process prone to error. After integrating Fire’s Payments API, GoodBox now automatically distributes funds to over 3,000 charities when settlement funds arrive. Webhooks notify the team when funds are received, and payment batches are submitted and reconciled instantly, ensuring fast, accurate, and scalable disbursement while freeing up resources for other high-value tasks.

GRID Finance – managing flexible finance repayments for Ireland’s fastest growing business lenders

GRID Finance provides flexible funding to SMEs across Ireland. For each merchant, GRID creates a Fire sub-account in real time, using it to collect card settlement funds. Their platform then calculates repayment amounts and settlement portions, triggering automated payouts through the Fire Payments API. Real-time notifications and automated reconciliation allow GRID to process transactions instantly and accurately, reducing manual effort from 1.5 hours to just 15 minutes per day while maintaining full control and visibility over payments.

Webinar Q&A: questions from attendees

The session concluded with a Q&A covering implementation, timelines, and practical considerations. Key questions included:

What does the integration process look like, and how long does it take?

The integration timeline depends on the depth of implementation. In many cases, the technical integration can be carried out within a day or two, subject to resources and requirements. Fire’s product team works closely with each business throughout the process, providing guidance and supporting the specific use cases they want to enable through the API.

How is payout automation expected to evolve, especially in relation to SEPA instant?

Demand for payment automation is growing rapidly, driven by rising consumer expectations. Businesses adopting integrated, automated solutions can take full advantage of instant payments, streamline flows across suppliers and payees, and differentiate their offerings. Fire aims to help businesses unlock these opportunities.

Can businesses pay out US Dollars via the API, and are these payments instant?

Yes, you can pay out in US Dollars (USD) and any of the other currencies Fire supports via the API. Standard bank transfer batches include euro and sterling, while international transfers, such as US Dollars, are processed through local payment rails like the US ACH network rather than SWIFT, keeping costs lower. These payments are not instant and typically take around one business day. Our team can guide you on setting up these payouts via the API.

Is there a ready-made solution for merchants using Shopify or Business Central?

Fire integrates via API and supports use cases where platforms manage recurring invoice collections or direct debit payments. While Fire does not originate direct debits itself, inbound collections can be handled through a third-party partner, with funds settling into a Fire account, and outbound direct debit payments can be managed directly through the Fire platform.

How can we get access to the API?

The Fire Payments API is ready to use and available to all Fire customers at no extra cost. You can explore the full range of services in the API documentation on our website, and our team can guide you through the integration process. There are no extra requirements or hidden features: any customer can get started with the API as soon as they are ready.

Are there safeguards in place to prevent accidental batch payments?

Yes, there are safeguards to prevent accidental batch payments. Only authorised users can initiate payments, and credentials are securely managed. Businesses can restrict access, store credentials safely, and set approval rules (such as requiring multiple admins to approve a batch), so no single user can process payments alone. These measures make API usage as secure as direct account access, and we can advise on best practices to further strengthen protection.

What kind of time savings or efficiency improvements have clients seen?

Clients using the Fire Payments API have seen significant time savings and efficiency improvements. In one case, automating payouts freed up around 1.5 full-time equivalents from accounts payable, allowing the team to focus on higher-value tasks. In another example, a larger acquirer in the UK reduced funding and settlement times from T+3 to T+1, speeding up payments to merchants while improving operational efficiency. These gains show how automation benefits both finance teams and end-to-end payment processes.

Transforming payment operations with automation

API-based automation will continue to shape how organisations manage high-volume payment flows. Fire supports businesses looking to integrate automated payouts, embed payments within their platforms, and scale operations efficiently.

–

If you would like to learn more about API-driven payouts or discuss your requirements, contact us at sales@fire.com. If you would like to be notified about our future webinars, feel free to sign up to our mailing list.