Verification of Payee explained: key takeaways from our recent webinar

Article snapshot

Providing an overview of the Verification of Payee service, insights from Fire’s recent client webinar, and the key questions businesses raised about its introduction and impact.

Exploring VoP, its impacts and what our clients are most curious about.

–

Setting the scene: Why Verification of Payee matters?

Verification of Payee (VoP) is a name-checking service designed to ensure payments are sent to the intended beneficiary, helping to reduce the risk of misdirected payments. Similar to the UK’s Confirmation of Payee, VoP will become mandatory for all payment service providers in the eurozone under the instant payments regulation, with operational go-live from 5 October.

Given the significance of this development and its impact on euro payment processes, our product team hosted a webinar for clients to provide further insight.

The session formed part of our ongoing webinar series on payment industry trends and developments and included an overview of VoP, its operational impacts, a demonstration, and the key considerations for businesses as the service is introduced.

What is Verification of Payee?

Verification of Payee confirms that the name entered for a bank transfer or Electronic Funds Transfer (EFT) matches the name held by the beneficiary’s payment service provider (PSP). This reduces the risk of miskeyed payments, invoice redirection fraud, and other operational errors.

When adding a new payee, Fire can check that the account name, BIC, and IBAN correspond with the records held by the receiving PSP, ensuring the payment is going to the intended account.

VoP responses fall into four categories:

- Full match – the payer’s entry exactly matches the registered account details.

- Partial or close match – minor differences, such as a missing letter, but close enough to confirm and present the full match option back to the payer.

- No match – the name does not match, prompting the payer to double-check the details.

- Unable to match – the system cannot confirm the account, for example due to a non-existent IBAN, a closed account, or system latency.

For business accounts, the payer will need the exact business name registered to your account, which can be confirmed in the Company Profile section.

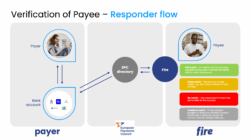

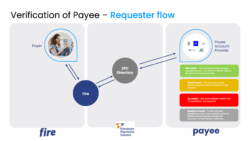

VoP applies to both sides of a payment: the responder side, when your Fire account is being verified by a payer, and the requester side, when you verify a payee before making a payment.

How VoP works in practice?

During the webinar, we demonstrated the VoP interface and explained the operational flow:

- When adding or sending payments through Fire, each beneficiary check is routed via the EPC directory to confirm that account details match.

- Businesses can see whether each payment is a full match, partial match, no match, or unable to match before submission.

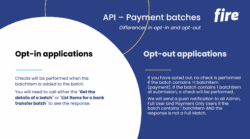

- For batch payments via API, clients can opt in or out of VoP checks. Opting in triggers a check for every payment in the batch, while opting out allows single-item batches to bypass automatic checks; multi-payment batches are exempt.

This approach helps reduce operational overhead and gives businesses confidence that payments are sent to the correct accounts.

Webinar Q&A: practical questions about VoP from our clients

The webinar concluded with a Q&A session where attendees asked practical questions about the implementation of the Verification of Payee service. We were pleased to see the high level of engagement and received a range of insightful questions from businesses.

How can one opt in to Verification of Payee for batch payments?

When creating a new application once VoP goes live, businesses can choose whether to opt in or out of VoP batch checks. This option will appear alongside other settings such as approver counts.

Will existing applications be defaulted to opt-out?

Yes. Any applications created before the Verification of Payee service goes live will be defaulted to opt-out. New applications can choose to opt in or out when they are created.

Is there an API call to proceed with “partial match” / “no match” payments, or do these need to be authorised via the Fire App only?

For applications opted out of VoP, single-payment batches require authorisation via the Fire app. Opting in allows batch submissions without additional authorisation, including single payments.

Can “partial match” or “no match” messages be returned by webhooks?

Partial and no match responses are not automatically returned via webhooks. Businesses can retrieve these responses through API calls. Fire may explore returning these via webhooks in future updates.

How sensitive is the system to name variations, such as Sam vs Samuel or Joe vs Joseph?

The system is sensitive to differences in personal names. To avoid unwanted match results (partial and no match), please ensure the recipient’s name is entered exactly as registered.

Is there a way to check beneficiaries in advance to identify potential “no match” or “partial match” results?

Businesses can include multiple beneficiaries as batch items and retrieve the match results through the batch API. Batch items with partial or no match responses can be removed before submission. Also, the batch can be cancelled afterwards if it is not required.

Does the EPC have a listing of swaps (Limited / Ltd.) or is it strictly one character difference?

The system ignores business descriptors such as “Limited” or “Ltd” during name matching. This prevents unnecessary partial or no match results based on these common variations.

The discussion highlighted the practical considerations businesses face when adopting Verification of Payee. Fire will continue to provide updates and guidance to ensure a smooth transition and to help clients make the most of this new service.

Scanning the horizon

Fire continues to monitor upcoming regulations and innovations in payments. Our product roadmap includes the introduction of SEPA instant credit transfer and PSD3 updates, which will influence instant payment capabilities, licensing harmonisation, and API enhancements for open banking.

By listening to client needs and providing clear guidance on new services, Fire supports businesses in adopting Verification of Payee while preparing for future developments in payments.

If you would like to learn more about VoP or discuss your requirements, contact us at today. To be notified about future webinars, send us an email to sales@fire.com and we will add you to our mailing list.