Using open banking payments to improve payment acceptance

Article snapshot

This article explores how open banking provides a fast, secure, and cost-effective way for merchants to accept payments directly from customer bank accounts, complementing card payments and offering more choice at checkout.

How account-to-account bank payments are lowering costs and improving reconciliation for merchants.

–

Rethinking payment acceptance

Traditional payment acceptance works well in many cases, but it’s not without its challenges. Card fees can reduce margins, chargebacks add complexity, and fragmented data often slows down reconciliation.

Account-to-account, or open banking, payments are a strong alternative in scenarios such as high-ticket purchases or where real-time confirmation of funds is essential. By allowing customers to pay directly from their bank accounts, open banking can help merchants reduce costs, speed up settlement, and improve security through bank-led authentication.

As of 2023, 13% of digitally active consumers and 18% of small businesses in the UK are using open banking services, a number that’s expected to grow further.

In this article, we explore how open banking simplifies payment acceptance for merchants, while helping to cut costs and reduce fraud.

What is open banking payment acceptance?

Open banking payments are a method of payment acceptance that simplifies payment processes while reducing costs and providing other benefits for merchants and their customers. This method can be offered alongside or as an alternative to other payment methods and is often integrated through APIs, which enable seamless communication between merchants and payment providers.

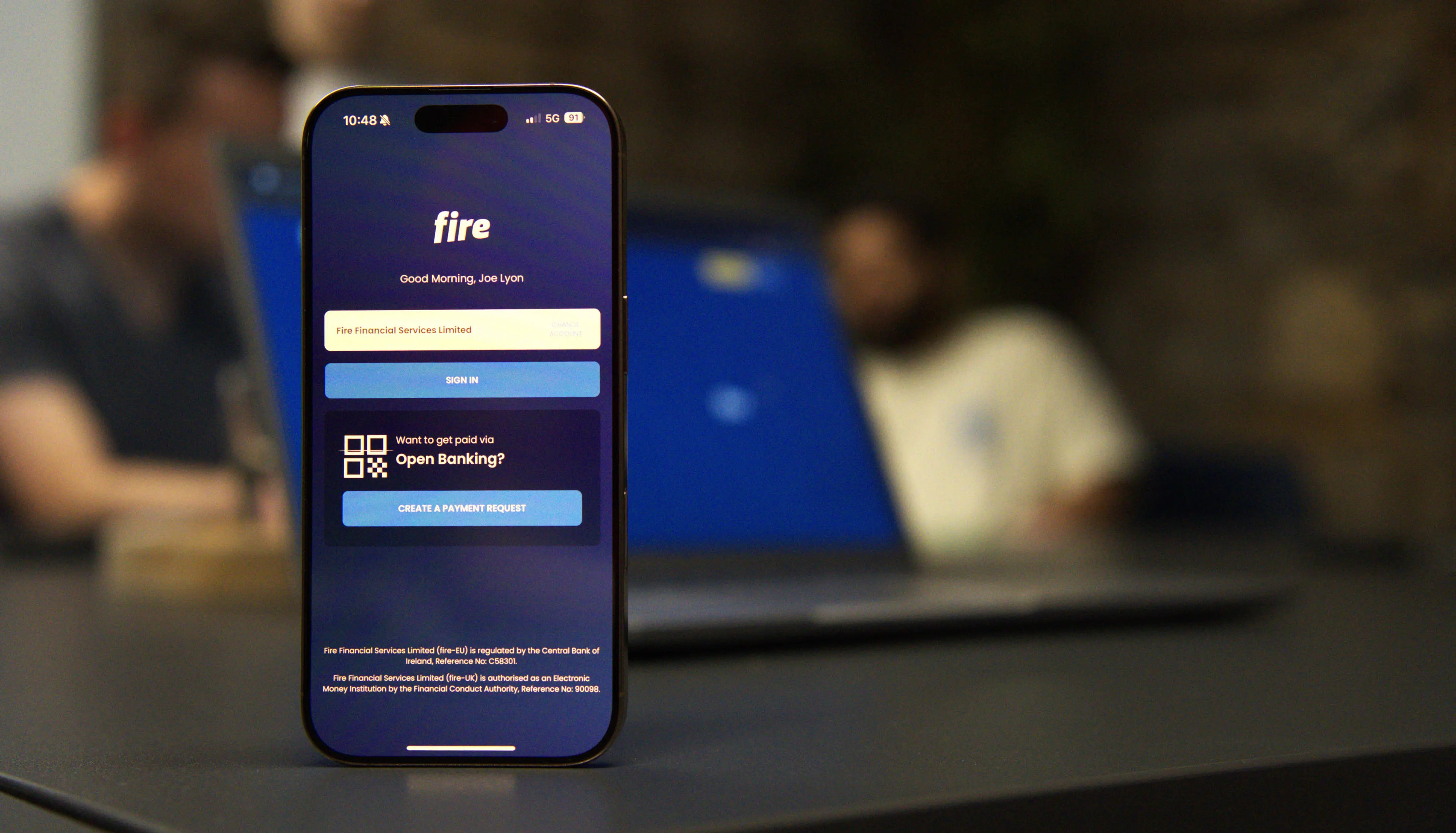

Fire’s Payments API is designed to handle this integration efficiently. Merchants can use the API to set payment parameters such as the amount, customer-facing details, and transaction data for reconciliation. The API then generates a unique URL that redirects the customer to authorise the payment in real time. Merchants receive notifications on changes to a payment status as it happens.

Merchants can select a provider that offers payment initiation only (settling funds into an existing account) or choose a provider like Fire that offers both payment initiation and collections accounts.

While many benefits, such as lower costs and faster settlement, come with both options, using a provider that offers payment initiation alongside collections accounts adds advantages like improved reconciliation through comprehensive data and easier tracking of payment status.

Compared to card or wallet payments, open banking lets customers pay directly from their bank accounts, reducing fees and chargebacks while providing clearer payment data.

Why accept payments via open banking?

Lower fees

While card payments remain a widely used and effective option, they can carry higher per-transaction costs, particularly for high-value purchases. Open banking payments typically involve fewer intermediaries, helping to reduce overall processing fees.

For some businesses, the savings are significant. More than 20% of organisations spend between £20,000 and £50,000 annually on payment processes, but those using open banking report notable reductions in transaction costs. These savings also contribute to smoother, more efficient operations, with businesses saving over 12 hours each month on payment-related tasks alone.

Reduced fraud & chargebacks

Open banking payments offer enhanced security through Strong Customer Authentication (SCA), which verifies the payer’s identity using two or more authentication factors and is handled directly by the customer’s bank. This reduces the risk of fraud and eliminates chargebacks, as payments are authorised in real time by the account holder. For merchants, this means fewer disputes, less time spent on resolution processes, and greater confidence in payment integrity.

Faster settlement

Open banking payments can settle more quickly than traditional card payments, which typically take one to three working days to clear. This faster access to funds helps businesses manage cash flow more effectively, which remains a challenge for many. In 2024, 24% of SMEs in the UK reported experiencing cash flow difficulties, with late payments (27%) and slow settlement (27%) commonly cited as key pain points.

For merchants, improved liquidity means being able to pay suppliers and meet loan obligations on time. Fire also provides real-time confirmation of funds, giving merchants greater assurance and enabling them to release goods with more confidence.

Improved reconciliation

Open banking payments support cleaner, more consistent reference data, making it easier to match incoming payments to invoices and customer records. With automation-ready flows and the option to set flexible settlement frequencies (such as once or twice daily), merchants can streamline their reconciliation processes and reduce manual effort. This can save time, lower the risk of errors, and improve overall operational efficiency.

Security

A key advantage of open banking payments is that merchants never handle or store sensitive payment information. This significantly lowers the risk of data breaches, which can expose sensitive financial information, like card details, and cause serious reputational and operational harm.

Because open banking removes the need to process card data, merchants are no longer subject to the full scope of PCI DSS (Payment Card Industry Data Security Standard) requirements. This helps reduce compliance overhead while strengthening the overall security of the payment process.

Open banking in action: key use cases

One of the advantages of open banking payments is their flexibility across different channels, ranging from in-app links to QR codes and even NFC tags. This versatility makes them suitable for several different use cases.

E-commerce and retail

Open banking payments can be integrated into the online checkout via the Fire Payments API, offering customers an additional or alternative way to pay. Unlike cards, this method doesn’t require 3D Secure or the storage of sensitive card details. The lower cost per transaction, especially for higher-value orders, makes it particularly attractive for industries like automotive retail.

Charities and donations

The combination of low acceptance costs and flexible payment link distribution makes open banking an appealing option for charities. It enables smoother donation experiences, reduces processing costs, and supports better campaign tracking through richer data.

The merchant perspective

Open banking continues to grow across the UK and Ireland, with adoption increasing year on year. According to Open Banking Limited’s report from May 2025, a record high adoption rate shows that 1 in 5 consumers and businesses now use this payment method, up from just 1 in 17 in March 2021.

Merchants are choosing open banking to complement existing alternatives, offering customers more choice while reducing costs, fraud, and operational overhead. For e-commerce in particular, open banking payments are easy to integrate, support smooth checkout experiences, and remove the need to store card details.

With faster settlement, lower transaction costs, and improved data, open banking is becoming a valuable addition to the payment stack for businesses looking to improve efficiency and resilience.

How to integrate open banking payments

Merchants can easily integrate open banking payments using Fire’s API, either as a standalone option or alongside other payment methods.

Plan and design

Start by defining your requirements and designing your integration with Fire’s API. Every business has different needs, and the Fire Payments API offers flexibility to support a range of use cases, from open banking payment acceptance to additional services like automated payouts, on-demand account creation, FX and international transfers, and more. Our team is happy to work with you to understand your requirements and explore your options.

Integrate

Once your design is in place, you can begin developing against the API. A test account allows you to explore endpoints and webhook messages before moving to live transactions.

Test

Validate your implementation by testing payment flows, webhook notifications, and API responses. This helps ensure a smooth experience for your customers and internal systems.

Go live

When testing is complete and you’re satisfied with the setup, you’re ready to go live and start accepting open banking payments.

How Fire supports open banking integration

Fire enables businesses to accept open banking payments through a straightforward, developer-friendly API. Our platform supports both SEPA and Faster Payments rails, making it suitable for businesses operating across the UK and Ireland.

Beyond payment initiation, Fire provides real-time payment tracking and comprehensive reference data to support efficient reconciliation. This helps reduce manual processes and gives merchants greater visibility over incoming funds.

Fire’s infrastructure is built for scale, supporting high-volume, enterprise-grade payment acceptance. Whether you’re embedding open banking into an online checkout or distributing links across multiple channels, we offer a reliable and flexible foundation to help you launch and grow with confidence.

Building a flexible payment stack

As businesses look beyond traditional card-based methods, account-to-account payments are becoming a valuable part of the modern payment stack. Open banking offers speed, security, and cost savings, helping merchants streamline operations without compromising on customer experience.

By adding open banking alongside existing options, businesses can increase flexibility, reduce reliance on any single method, and build greater resilience into their payment infrastructure.

Ready to reduce fraud, lower costs, and simplify payment acceptance? Contact the Fire team to find out how our Payments API can help transform the way your business gets paid.