Modernising food and beverage distributor payments

Article snapshot

This article explains how food and beverage distributor payments can be optimised, reducing errors and strengthening supplier relationships through automated payments and open banking solutions.

How payment automation and open banking improve fast-moving consumer goods (FMCG) payouts, supplier relationships, and operational efficiency.

–

Food and beverage distributor payments are increasingly managed through modern payment technologies, as margins and trusted relationships become ever more important in the sector.

With Irish food and drink exports valued at €9.4 billion in the first half of 2025, up 17% year on year, the industry continues to grow despite tight margins and rising input costs. Businesses that embrace payment innovation can gain a competitive advantage over others in the market. Many distributors are moving away from manual processes and adopting faster, more transparent solutions enabled by payment automation, open banking, including foreign exchange (FX) services to support global exports.

Innovations such as accounts payable (AP) automation and open banking are giving distributors greater visibility and control over supplier payments. By integrating AP tools with payment platforms, businesses gain real-time insights into payments, inventory, and cash positions. Secure account-to-account transfers, instant confirmations, and automated reconciliation reduce costs, improve cashflow visibility, and strengthen supplier relationships across the supply chain.

This article explores how payment automation and open banking solutions are transforming the food and beverage industry, helping businesses reduce administrative work, improve cashflow visibility, and build stronger supplier partnerships in a fast-moving market.

Understanding food and beverage distributor payments

Managing food and beverage distributor payments is complex. Distributors often operate across fragmented supply chains involving multiple suppliers, currencies, and payment cycles. Global trends such as labour shortages creating ripple effects that can slow production and distribution, ultimately driving up food prices.

One of the main challenges is the risk of manual errors. Research suggests that when data is manually entered into spreadsheets or documents, the probability of a human error ranges between 18% and 40%. Another study estimates that failed payments cost the global economy $118.5 billion each year.

Many distributors still rely on card payments or manual transfers, which can lead to additional fees and delays. Maintaining predictable cashflow is difficult, particularly with fluctuating volumes and perishable goods. Limited visibility into payment status also makes it harder for suppliers to plan effectively and have confidence that payments will arrive on time.

These challenges make food and beverage distributor payments one of the least digitised yet most impactful areas for innovation. Automating fast-moving consumer goods (FMCG) payouts can reduce errors and costs, strengthen supplier relationships, and improve operational efficiency across the supply chain.

How automation is streamlining supplier payments

Automation is transforming how food and beverage distributors manage supplier payments. Manual uploads and approvals can be replaced with scheduled, rule-based workflows and automated batch transfers, enabling faster and more efficient processing.

Centralised dashboards give finance teams complete visibility into every supplier transaction, whether domestic or multi-currency, making reconciliation of FMCG payouts and supplier payments more accurate and transparent. Instant payment confirmations reduce disputes and follow-up queries, while integration with accounting and Enterprise Resource Planning (ERP) systems eliminates duplication and minimises human error.

The benefits of automation are clear. Distributors processing thousands of supplier payments each month can cut reconciliation time with automated batch payments and live status updates. Centralised cash management improves control and forecasting, while same-day settlements supported by open banking further enhance cashflow efficiency.

These capabilities demonstrate how automated, API-driven solutions are helpi’s bank account, open banking removes intermediaries and shortens settlement times in some cases. This can reduce card fees and processing delays, making supplier payments faster, more reliable, and cost-effective. For distributors managing complex supply chains, it can also simplify multi-party settlements, such as paying growers, bottlers, and logistics partners in a single, streamlined flow. Real-time payment notifications confirm receipt, improving supplier confidence and reducing follow-up queries.

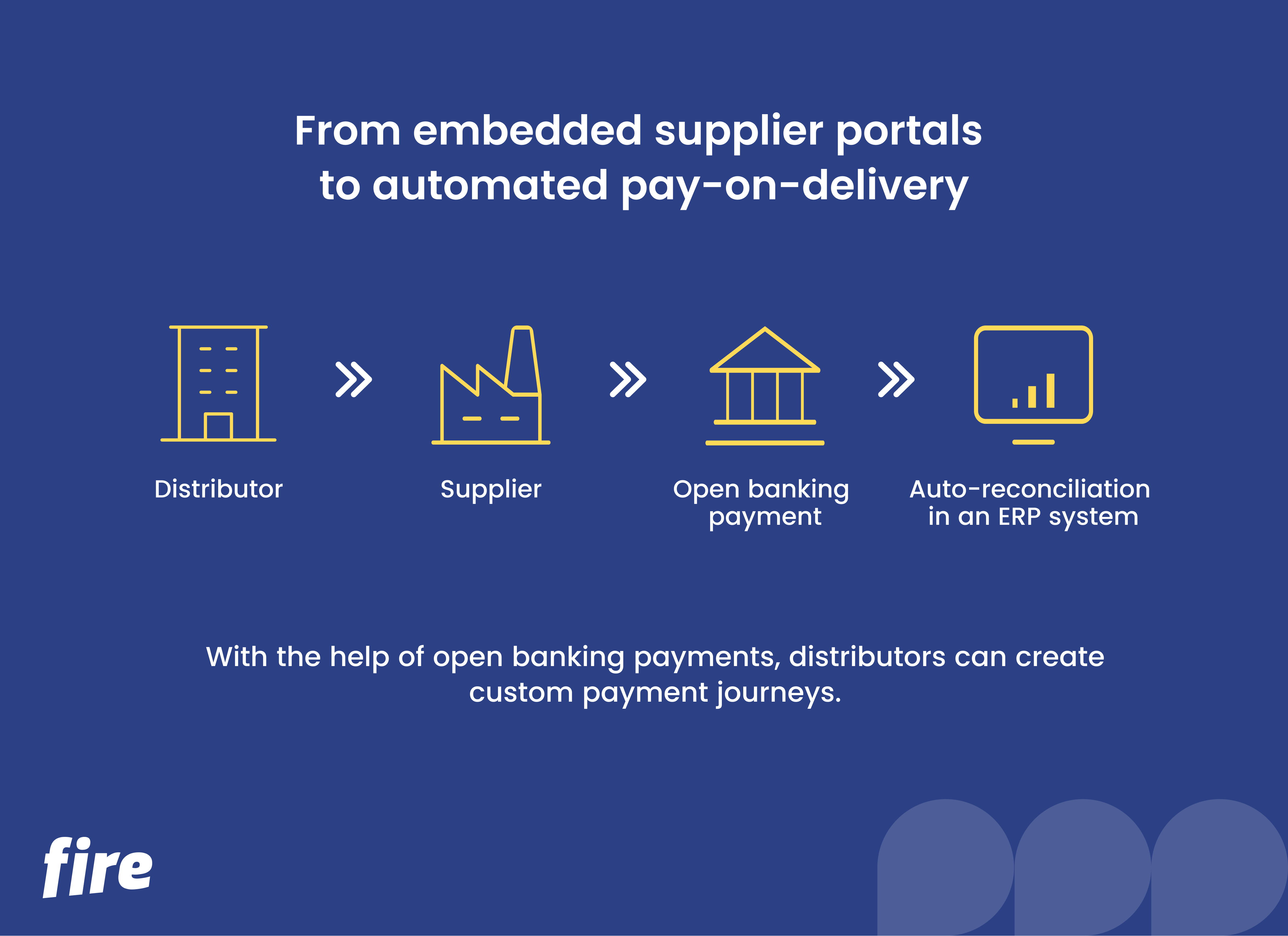

Open banking also supports tailored payment journeys as businesses seek more seamless and intuitive financial experiences. Distributors can create embedded supplier portals or automated pay-on-delivery workflows integrated with their ERP systems, replacing paper invoices with digital options like QR codes or payment links for smoother FMCG payouts and greater visibility across the supply chain.

Cost efficiency and cashflow benefits

For food and beverage distributors, efficient payment processes are key to maintaining competitiveness, particularly as inflation continues to drive higher costs across the supply chain. Rising costs for fertiliser, energy and transport feed directly into input prices for producers and distributors. In this environment, tighter margins mean that improving cost efficiency and cash-flow visibility has become more critical than ever.

Account-based payments enhance visibility of working capital, support liquidity planning, and reduce costs by removing card fees and high transfer charges. Automated approval workflows streamline internal processes, lower operational overheads, and allow finance teams to focus on strategic priorities. Early or scheduled payments can also strengthen supplier relationships, helping secure better terms and more reliable delivery arrangements.

Our case study on how we’ve supported MyMilkMan, operated by Tirlán (known as Glanbia Co-operative Society Limited from 1999 until 2022), provides a practical example. Representing hundreds of milk agents delivering fresh dairy products across Ireland, the distributor uses Fire’s payment platform to process daily payments in seconds, at least a day earlier than previous manual systems. By moving to faster, automated payouts, MyMilkMan has reduced costs, improved cashflow management, and increased supplier satisfaction, illustrating how modern payment solutions can transform food and beverage distributor payments.

Strengthening supplier relationships through transparency

For food and beverage distributors, speed and visibility in payments are key to maintaining supplier trust. Instant payment confirmations and shared transaction histories give suppliers clear visibility into when funds are received, reducing disputes and administrative delays. This transparency strengthens confidence and fosters stronger, longer-lasting business relationships.

Open banking is accelerating this shift by enabling faster, more efficient, and more transparent financial transactions that encourage closer collaboration across the supply chain. Faster and more transparent payments can enhance supplier loyalty, but also improve collaboration and can lead to more favourable commercial terms. Supplier finance arrangements further increase flexibility in managing working capital, while consistent and predictable payments reinforce reliability, positioning distributors as trusted partners in competitive supply chains.

By adopting automated payment solutions and leveraging open banking, distributors can enhance operational efficiency, strengthen supplier relationships, and optimise payment processes across the food and beverage supply chain.

Practical steps to adopt automated supplier payments

Food and beverage distributors can begin modernising their payments infrastructure with a few simple steps:

- Audit current process: Identify bottlenecks, manual touchpoints, and high-volume supplier transactions.

- Select a provider with API access: Providers like Fire enable integration with ERP or invoicing software.

- Set up payment rules: Automate transactions based on supplier type, invoice thresholds, or payment schedule.

- Pilot with select suppliers: Test automation workflows, real-time confirmations, and reconciliation accuracy.

- Scale gradually: Expand automation across your wider supplier network to maximise efficiency and consistency.

Building stronger, smarter supply chains

Optimising food and beverage distributor payments boosts efficiency, reduces costs, and strengthens supplier trust. Automated payouts and open banking can replace legacy processes with faster and more secure payments, improving cashflow visibility and supplier relationships.

Modernising supplier payments gives distributors a competitive edge and helps build more resilient, efficient, and trusted supply chains.

–

Want to learn how Fire can support your business? Contact us at sales@fire.com today to speak with our experts about a solution tailored to your needs.

FAQs

How can automation improve supplier relationships in food and beverage distribution?

Automation ensures suppliers are paid on time, every time, removing uncertainty and reducing manual errors. This builds trust and helps distributors negotiate better terms through reliability and transparency.

Why are open banking payments suited to the food & beverage sector?

The F&B industry relies on speed and volume. Open banking enables instant, secure payments without card fees or processing delays, which is ideal for managing high transaction volumes and perishable inventory cycles.

What’s the biggest obstacle to automating supplier payments?

Often, it’s system fragmentation. Many distributors use legacy ERP or invoicing tools that don’t integrate easily with payment platforms. Providers like Fire solve this with APIs that connect directly to existing systems.

Can automation help distributors manage multi-currency supplier networks?

Yes. Automated payment workflows can handle different currencies, schedules, and reconciliation rules across suppliers, reducing manual conversions and improving visibility across regions.

Does open banking reduce payment fraud risks?

Yes. Open banking uses Strong Customer Authentication (SCA) and direct bank-to-bank connections, which help reduce the risk of interception and account-takeover fraud. While consumer protections are still evolving compared to traditional card payments, open banking offers robust security standards that continue to improve.

How does Fire help distributors automate supplier payments?

Fire provides secure, regulated payment initiation services that let distributors schedule or trigger supplier payments via the Fire Payments API through webhooks. This simplifies reconciliation, improves visibility, and eliminates manual workflows.