Controlling debit card spend across business locations

Article snapshot

This post explores how businesses with multiple locations, such as car dealerships or coffee shop chains, can better monitor and manage debit card spending across branches to improve financial oversight and operational control.

Helping car dealerships, coffee shops and other multi-site businesses improve business debit card spend tracking through greater visibility and control.

–

Why spend visibility matters for multi-site businesses

Expense management can be challenging for any business, but for companies operating across multiple locations or branches, monitoring and controlling expenses efficiently is particularly complex. Without a streamlined approach to business debit card spend tracking, these companies often face operational inefficiencies and oversight issues.

By adopting a solution that facilitates centralised expense management and control while offering the flexibility to adapt to specific business needs, organisations can manage cross-branch spending through a unified, one-stop solution.

This article explores the key challenges businesses face when managing spend across multiple locations, and how modern payment solutions can improve efficiency, budgeting and oversight through enhanced business debit card spend tracking.

The challenges of multi-location spend

Managing expenses can be difficult for any business, but the added complexity of coordinating business debit card spend across multiple branches can introduce additional hurdles for finance teams.

Lack of visibility and oversight

Decentralised data creates a fragmented overview of expenditure that can lead to inaccurate forecasting.

Traditional expense management systems may have limitations in providing consistent oversight, which can make monitoring expenditure and proactively managing budgets more complex. This is particularly the case when tracking business debit card spend across multiple locations, where real-time assessment of current spend against allocated budgets can be less straightforward.

Process inefficiency: manual effort and error

Manual expense tracking, often relying on spreadsheets, can introduce errors, data inconsistencies, and increase administrative workload. These challenges tend to arise when consolidating reports from multiple locations, making tracking business debit card spend more complex. For instance, according to a recent publication, manual expense processes can take up to 20 hours per month per employee, placing a significant operational burden on finance teams and limiting opportunities for strategic work.

Reimbursement delays and challenges

One challenge of relying on employees to use their personal cards for business expenses is that reimbursement processes can sometimes be slow, from submitting an expense report to approving and completing the payment. This can lead to frustration for staff and impact the trust between employees and employers. Travel expenses, a common type of business spend, often highlight the cash flow impact of reimbursement processes. With companies incurring an average cost of $58 to process a single night’s hotel expense, the manual nature of expense reporting can slow teams down and add unnecessary cost.

Risk of employee expense fraud

The risk of employee expense fraud, such as inflating costs, submitting duplicate claims, or including personal expenses, can increase when robust control mechanisms are not fully in place. Managing company spending policies is more challenging when expense reporting and review rely on manual methods prone to inaccuracies.

What businesses need for effective business debit card spend tracking

To ensure efficient expense management and effective control, businesses benefit from a centralised solution that offers both flexibility and oversight. While specific needs vary across business models, common requirements for companies operating across multiple locations include the following features.

Centralised spend management

Achieving true efficiency in expense management depends on using a single, centralised solution to manage corporate debit cards and business debit card spend tracking. The ability to oversee the entire payment process – from issuing expense cards, budgeting, tracking and monitoring spend, to reconciliation – can significantly reduce administrative burden and enhance control.

Partnering with one trusted provider for corporate debit cards, along with other payment services such as international payments and FX conversions, payouts, payment acceptance, and API integration, can optimise overall payment processes and further reduce overhead.

Flexible corporate card issuing

The ability to issue corporate debit cards to employees helps businesses address several challenges related to expense management (see above), particularly those arising when employees use personal cards and submit reimbursement claims later.

Providing employees with dedicated expense debit cards eliminates reimbursement delays for both the company and staff, increasing employee satisfaction while also allowing the business to maintain control and oversight of card usage.

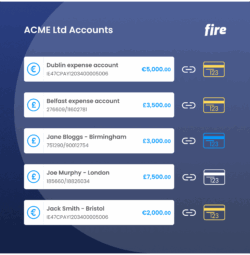

An effective solution should support real-time card issuance for any number of employees and enable the creation of branch-level current accounts on demand. This allows debit cards to be linked to the appropriate account with funds allocated specifically to that branch, supporting branch-level budgeting.

Transparency and oversight

Real-time notifications of card activity, such as card creation, authorisations, and payments, enable enhanced monitoring, helping businesses proactively identify issues and keep branch-level or overall budgets on track.

Being able to view all transaction data across teams and locations in one place, and integrate it with the organisation’s internal systems or accounting software, is key to effective business debit card spend tracking and accurate cash flow forecasting.

Issuing employee expense cards and actively monitoring spend also supports stronger policy enforcement and reduces the risk of employee expense fraud.

Robust budget management and control

Controlling spending is essential for effective expense budget management. For example, using multiple current accounts under one profile allows businesses to designate specific accounts for expenses, or even set up separate accounts for individual locations, departments, or cardholders, providing more granular control. This structure allows businesses to fund accounts on an as-needed basis and helps ensure budgets remain within set limits.

Further controls businesses can avail of include the ability to block and unblock cards on an as-needed basis (e.g. within specific timeframes or during travel periods), helping to manage when spending is permitted.

Dedicated user roles with segregated permissions ensure cardholders only access relevant data and card functionality, supporting greater control over business debit card spend.

Additional controls, such as multiple approvals or payment thresholds for payouts, can also help ensure oversight and control of expense reimbursement or other payment processes.

Benefits of centralised business debit card spend tracking

Reduced administrative overhead

Consolidating all expenses into one system, ideally one that integrates with existing accounting tools, can significantly reduce the administrative burden on finance teams.

Branch-level budget control

Segregating funds into designated accounts for each branch allows managers to easily review spending and assess whether budgets are being followed.

Improved cash flow forecasting

With centralised spend tracking, businesses gain a real-time view of all transactions and account balances in one place, supporting more accurate forecasting and effective business debit card spend tracking.

![]()

Industries that benefit the most from centralised expense control

While centralised business debit card spend tracking benefits all sectors, some industries stand to gain particular advantages, especially those with high operational complexity, multiple locations, or mobile workforces.

Car dealerships

These businesses often incur ongoing travel, parts ordering, and motor tax costs. Branch-level spend tracking in car dealerships also supports better visibility over local marketing expenditure.

Coffee shop chains and hospitality brands

Monitor supply and utility expenses at a store level, and manage local campaign budgets, branch by branch, to maintain control and flexibility.

Construction and trade businesses

Issue controlled debit cards to manage material purchases and travel expenses for mobile crews, with spend tracked by team or project.

Sales-driven organisations

Support regular spending on travel and events with individual cards for team members, while retaining full visibility of usage.

Field service companies (e.g. engineering or maintenance)

Simplify expense management for teams on the move, such as engineers travelling for installations or repairs.

Companies with significant advertising budgets

Segregate and track advertising spend by campaign, region or team using dedicated cards and accounts to maintain oversight.

Marketing agencies and gig economy platforms

Where spend is distributed across projects, clients or temporary staff, centralised tracking helps maintain clarity. Whether assigning cards to campaign teams or managing payouts to freelancers, a unified system supports better budgeting and streamlined reconciliation.

How technology streamlines spending oversight

In today’s evolving payments landscape, providers are offering increasingly flexible solutions with enhanced features to support more efficient business expense management and tracking. Introducing automation and adaptability into expense processes can significantly boost operational efficiency.

API-driven functionality for business debit card spend tracking

Accessing debit card functionality through an API allows for real-time spend tracking and notifications, seamlessly integrating with your internal systems. For example, webhooks – used on their own or alongside API requests – enable visibility into when cards are issued, payments are authorised, and transactions are settled.

On-demand card creation

Multiple business debit cards can be issued in real time and at scale, aligning with operational needs across teams and locations.

Granular budgeting

Multiple accounts can be established, with cards linked to specific accounts to support budgeting by branch or department.

Real-time data access

With 78% of CFOs identifying spend visibility as a top driver for automation, the need for effective business debit card spend tracking is clear. Real-time account data, downloadable statements, and direct integration with accounting software or backend systems all contribute to more informed decision-making.

Enhanced control features

Robust controls, such as blocking and unblocking debit cards, either manually or in an automated way through API integration, help support effective governance.

Not all business payment solutions are designed to meet the needs of businesses with multi-location operations. A provider that enables scalable expense management ensures that processes can remain efficient and controlled as the organisation grows across locations and teams.

Empowering smarter spending

The importance of real-time, branch-specific business debit card spend tracking cannot be overstated. Integrated payment solutions provide multi-site businesses with greater control, clarity, and operational efficiency. With the right digital tools and smart card management in place, expense processes can shift from being a source of friction to a strategic enabler of growth and financial stability.

Fire offers flexible business debit card solutions with real-time spend tracking across teams, branches, and accounts. Our case study with the Joe Duffy Group shows how centralised spend management can work in practice across multiple sites.

To explore how Fire’s corporate debit cards, automation capabilities and integrated payment services can help streamline your business payment processes, get in touch with our team.