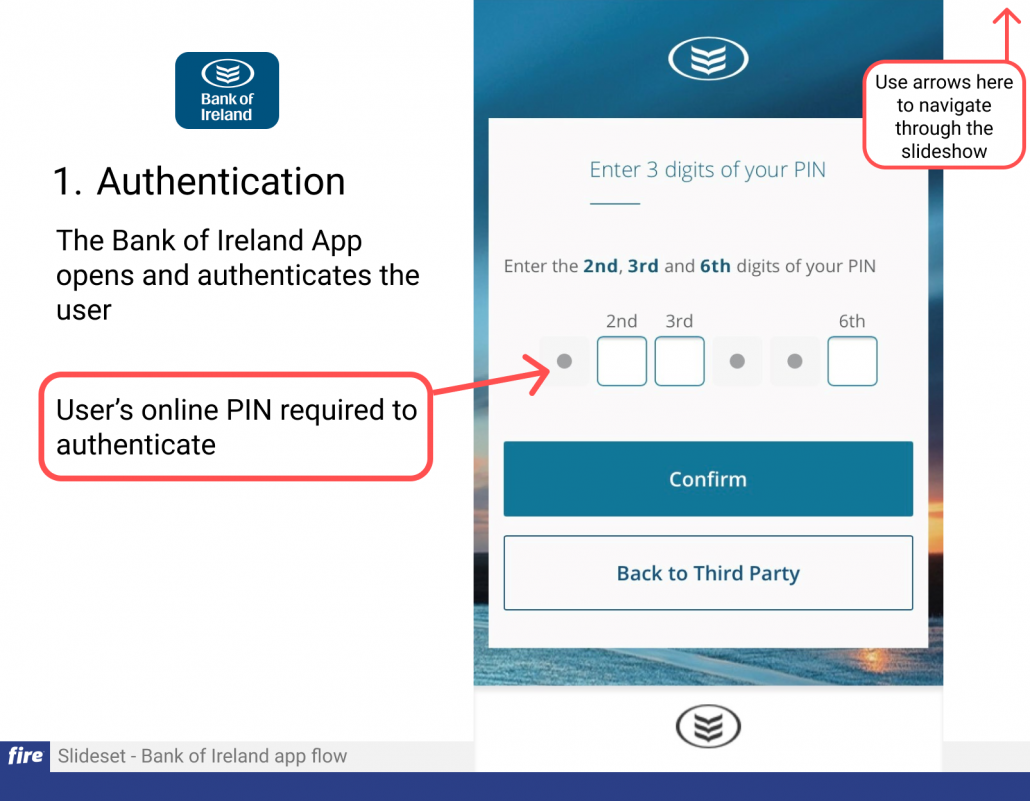

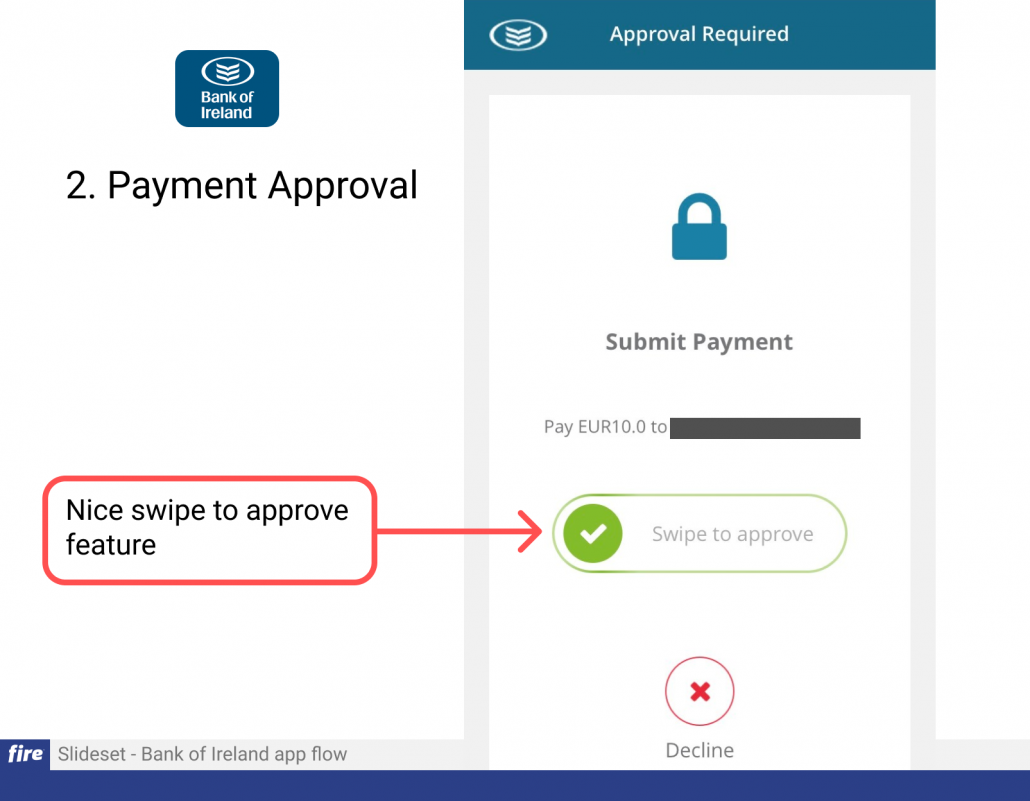

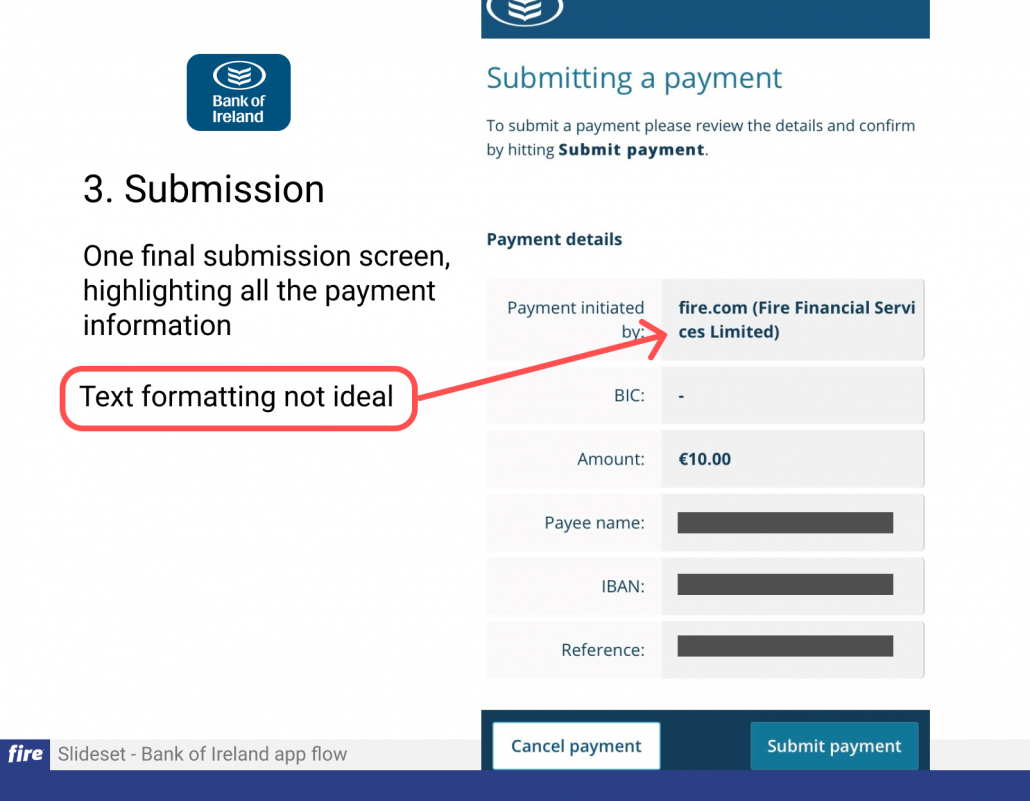

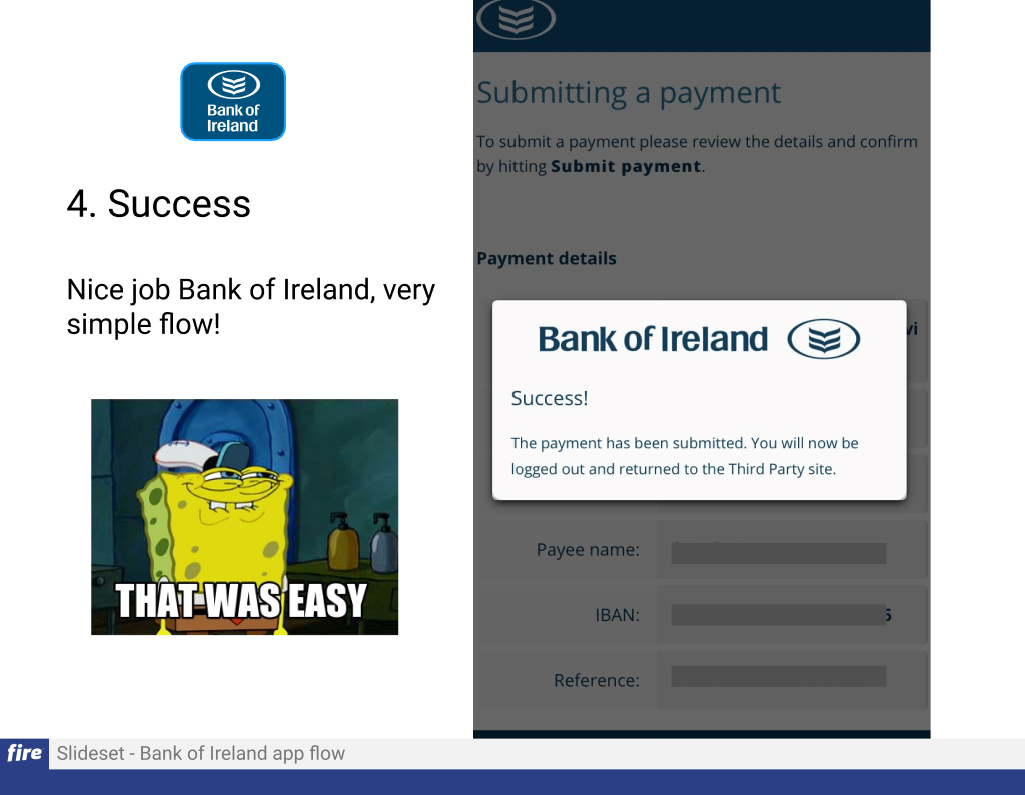

The Current State of Open Banking Payments in Ireland

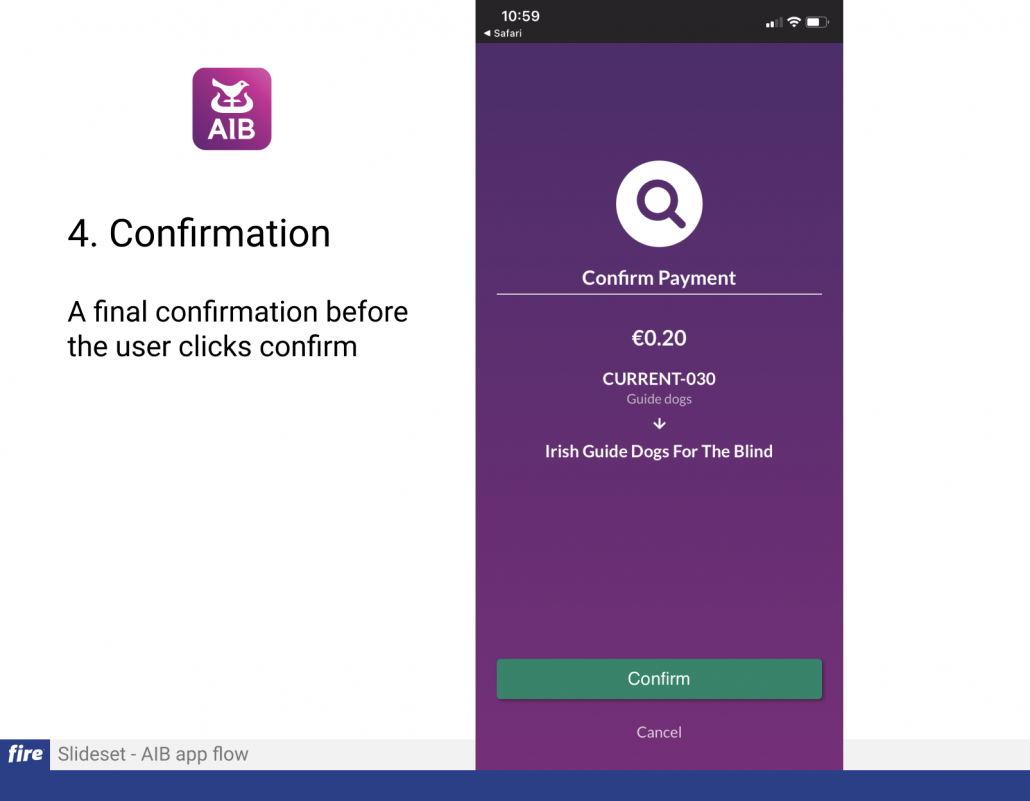

2021 has been a revolutionary year for Open Banking in Ireland. We are finally beginning to see Banks and Account Providers, collectively known as ASPSPs (Account Servicing Payment Service Providers), optimize their Open Banking payment flows making a more seamless payment experience for the customer. This new banking technology is game changing as it allows customers to make cardless payments using their mobile/desktop devices. Open Banking also reduces payment fees for the merchant and has enhanced security features.

To learn more about Open Banking Payments, please check out our previous blog: https://www.fire.com/the-steady-rise-of-open-payments/

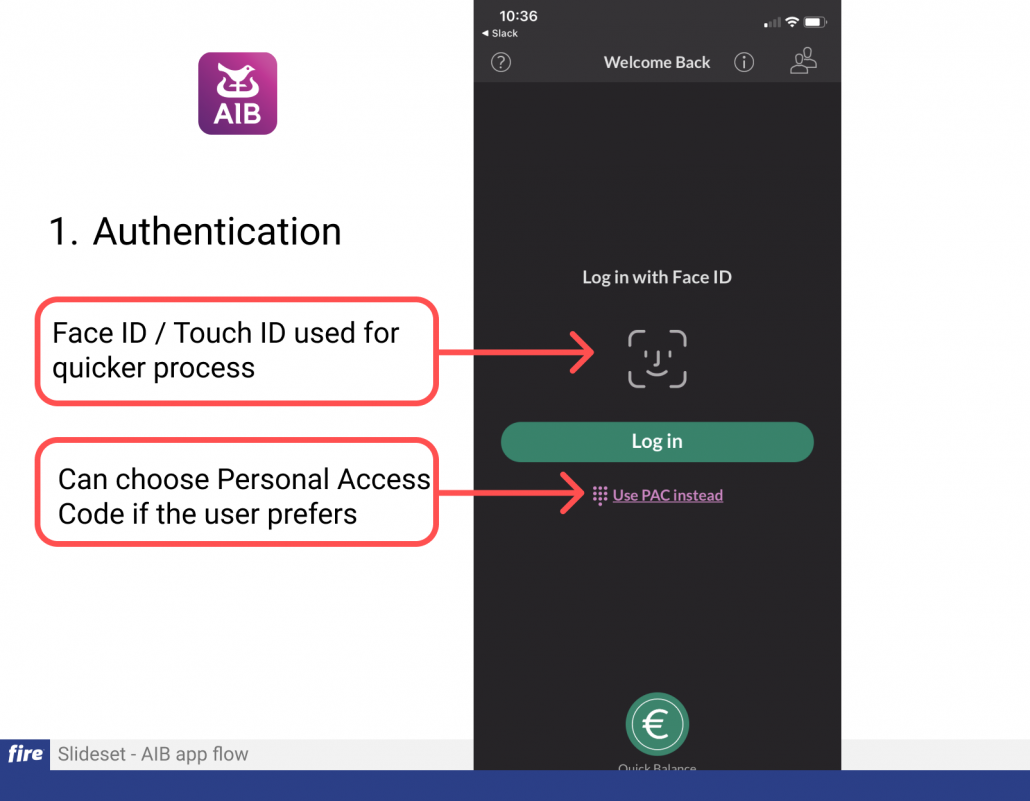

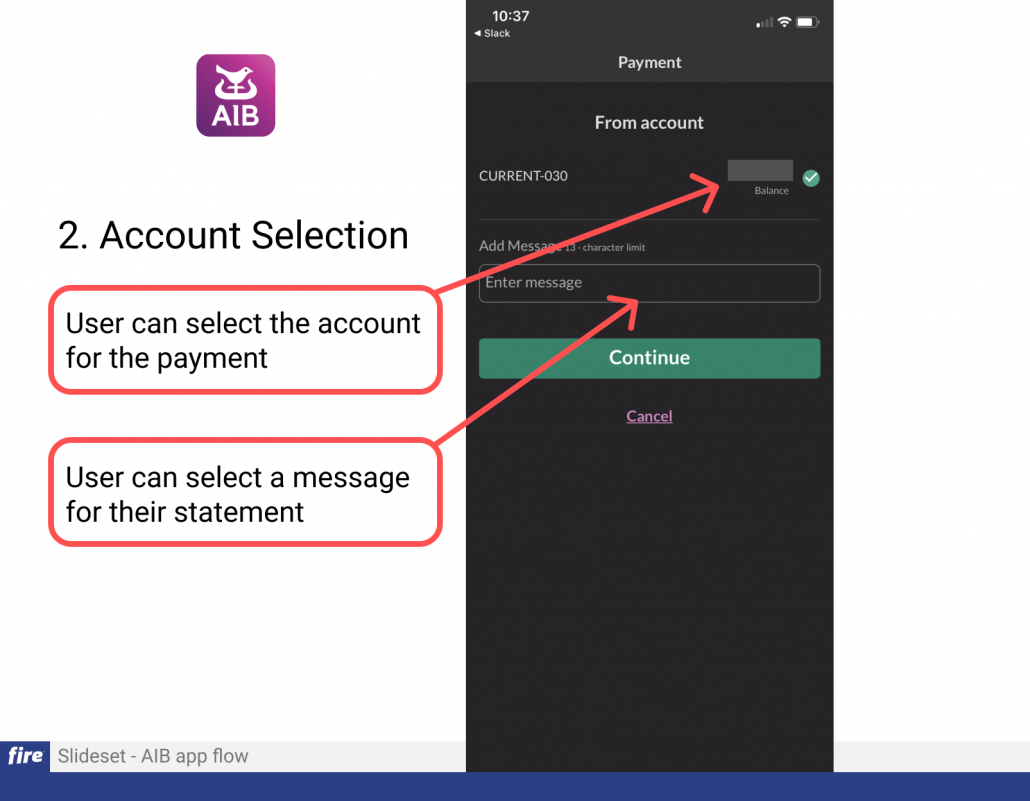

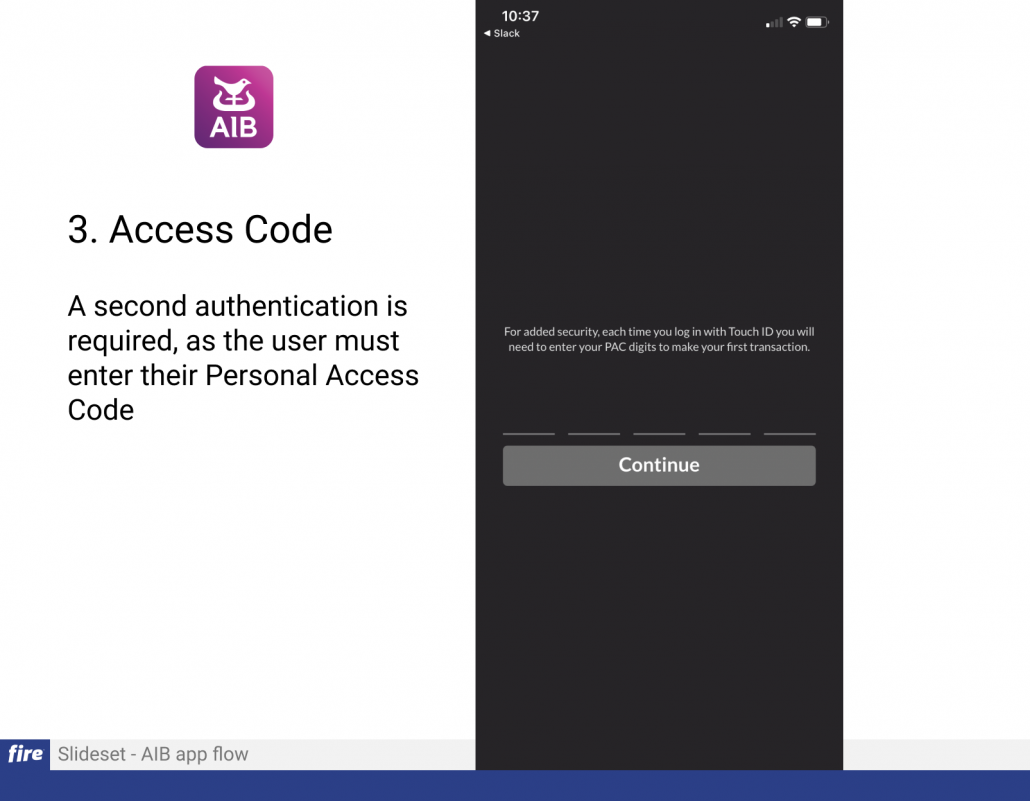

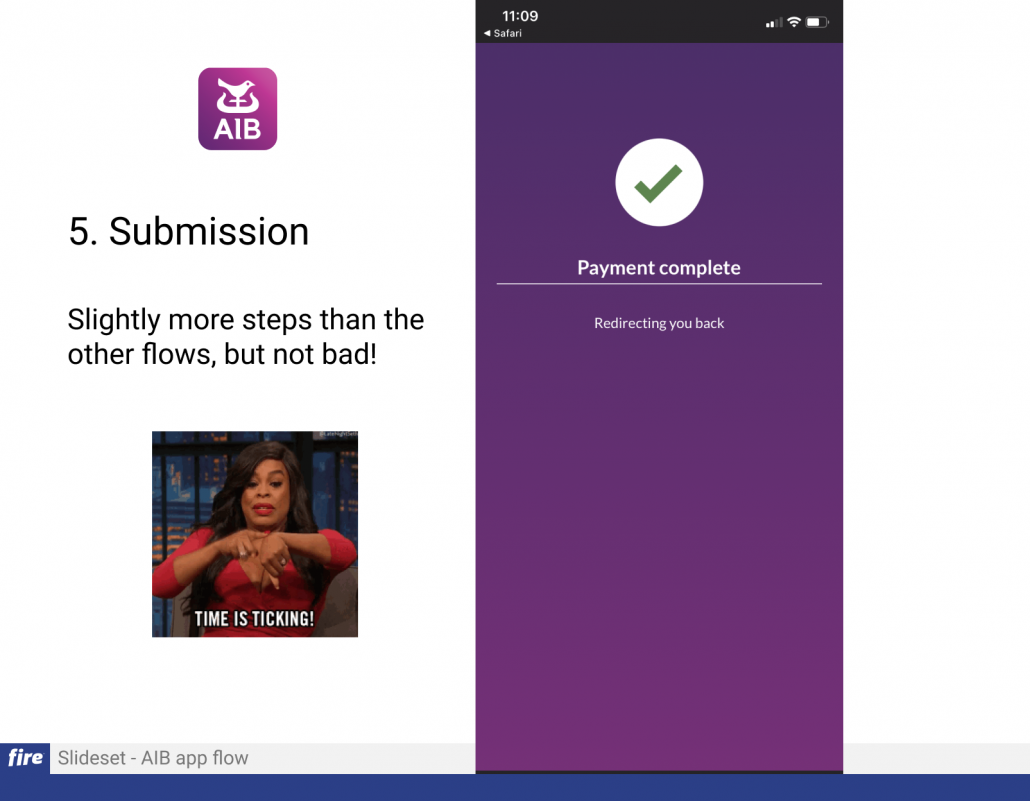

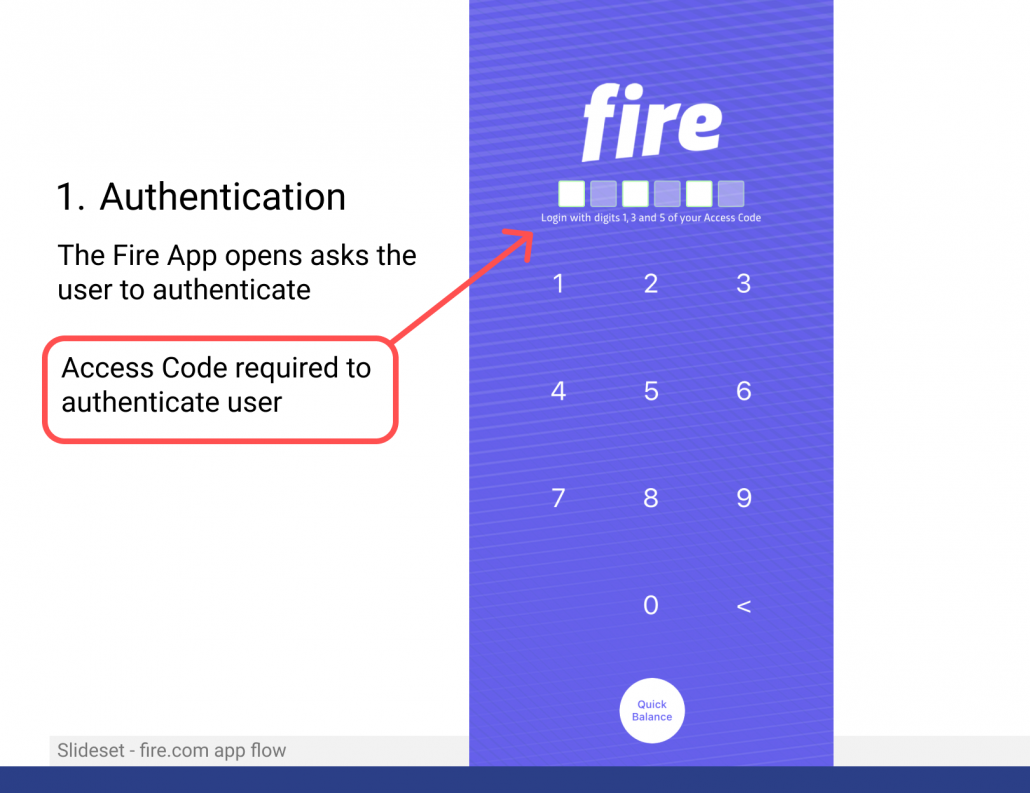

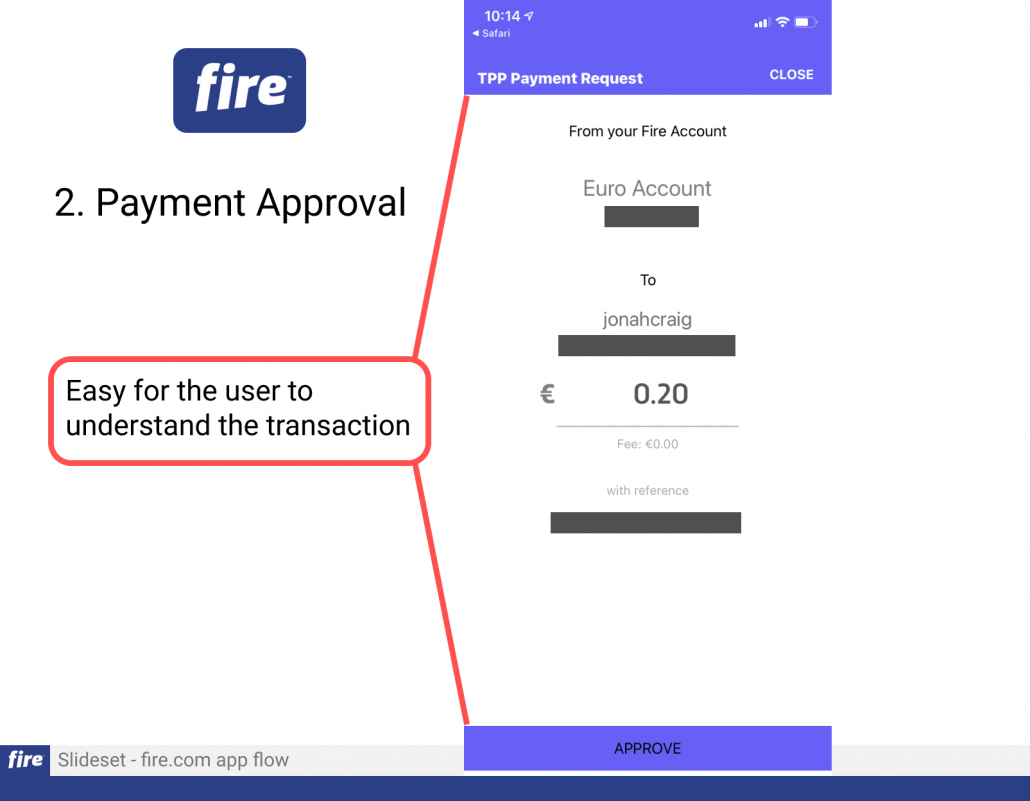

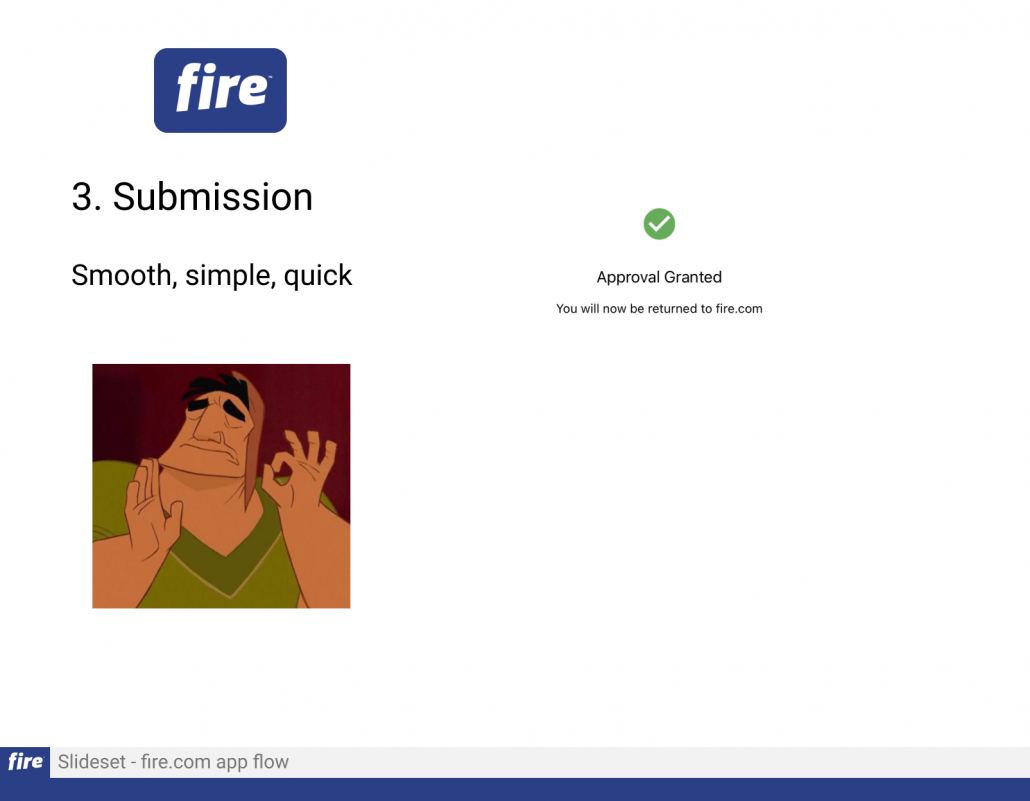

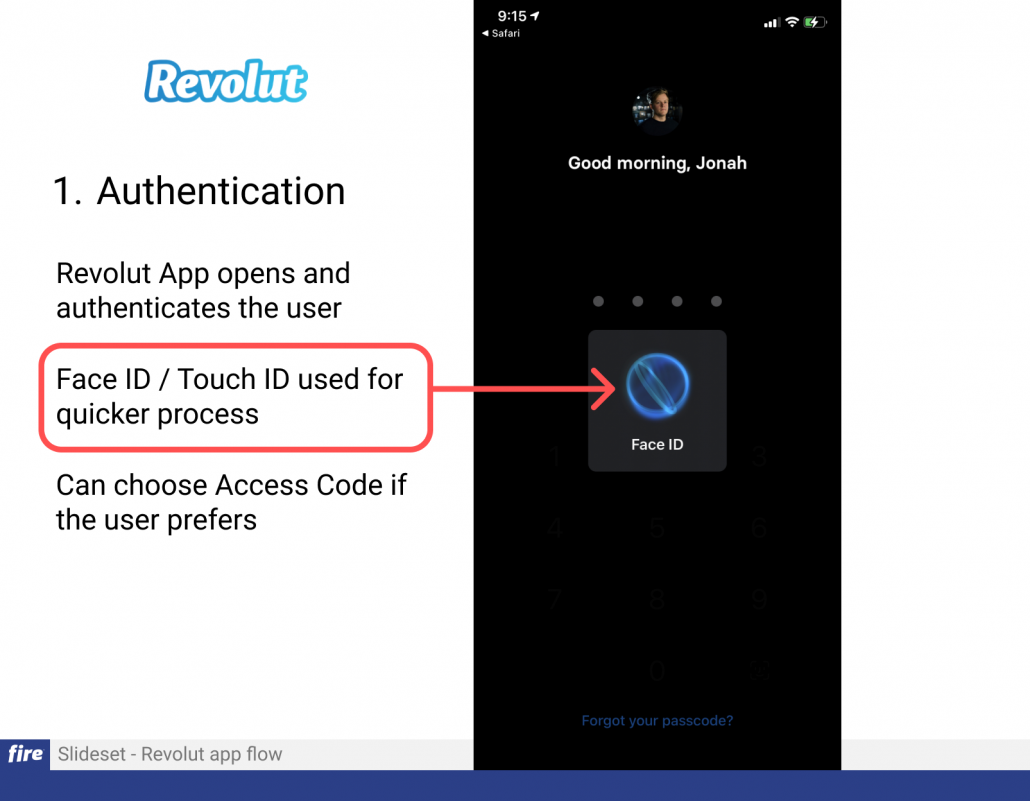

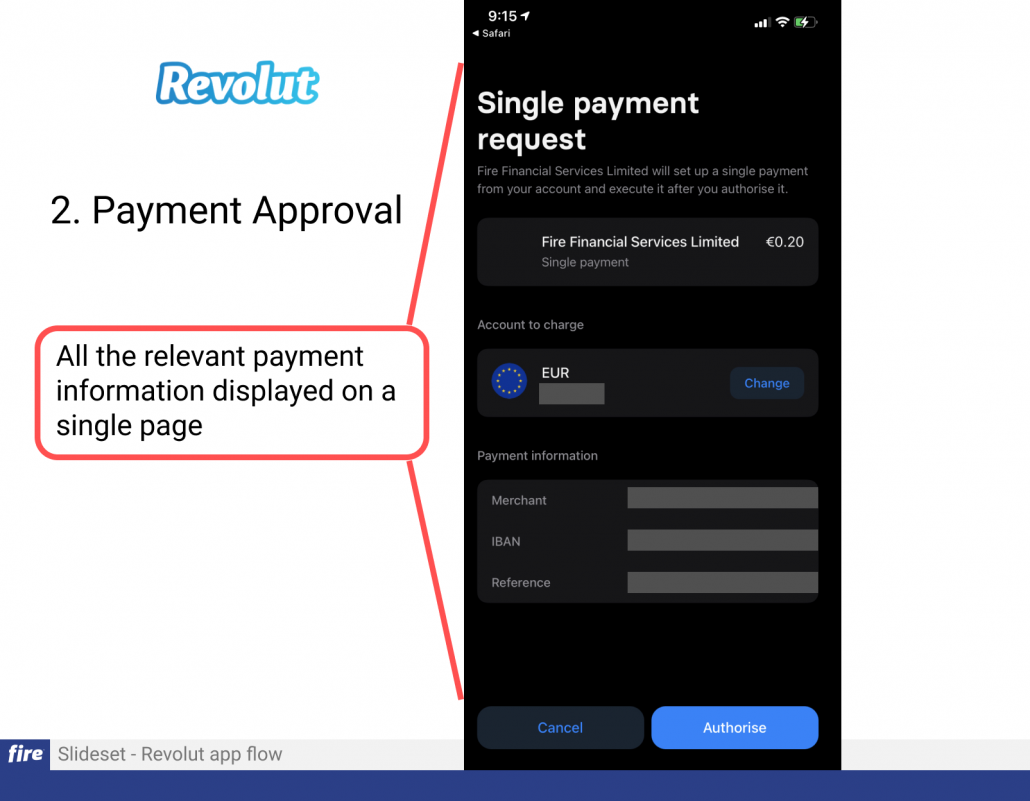

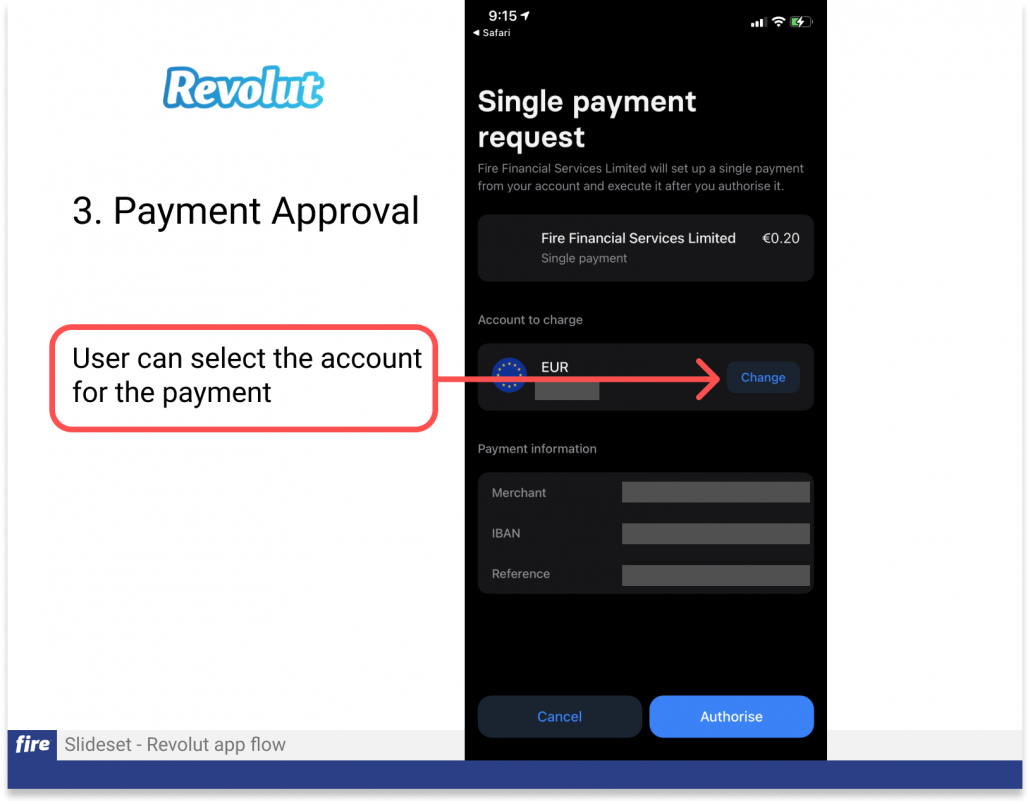

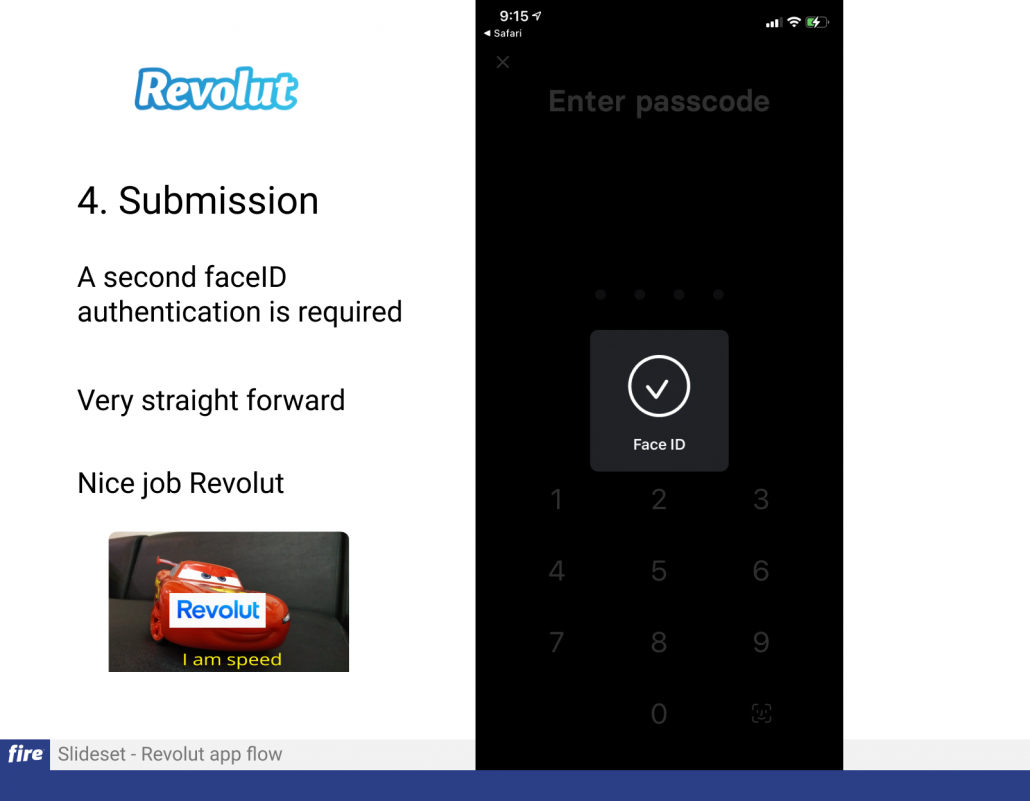

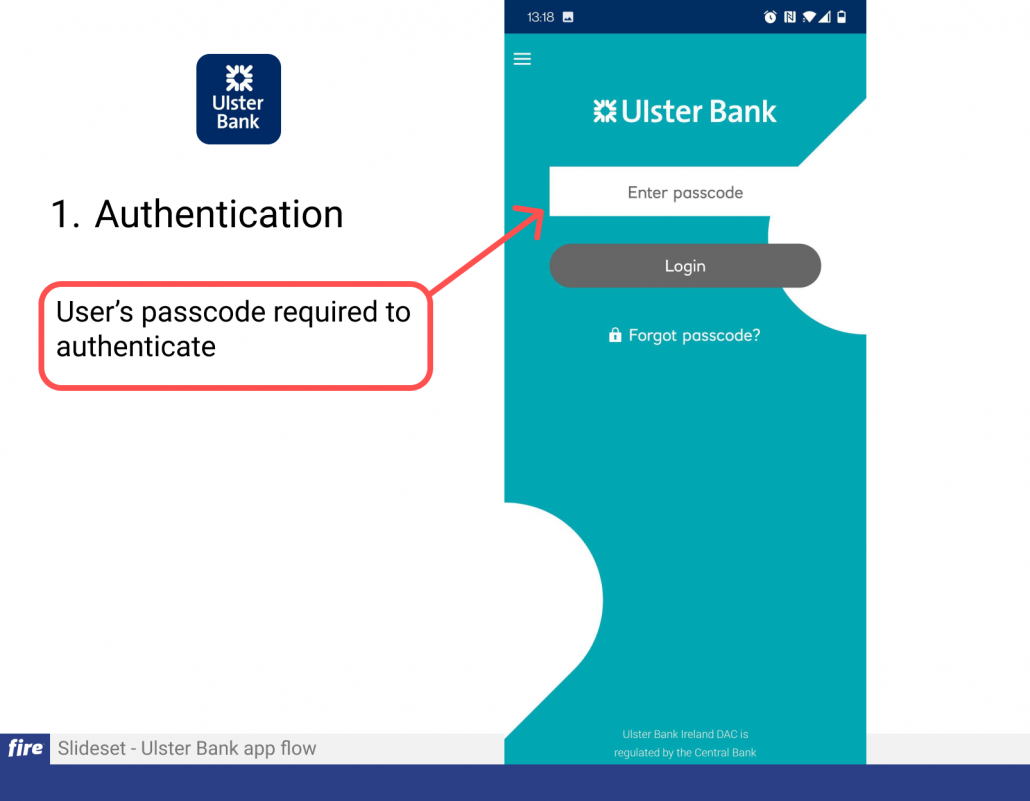

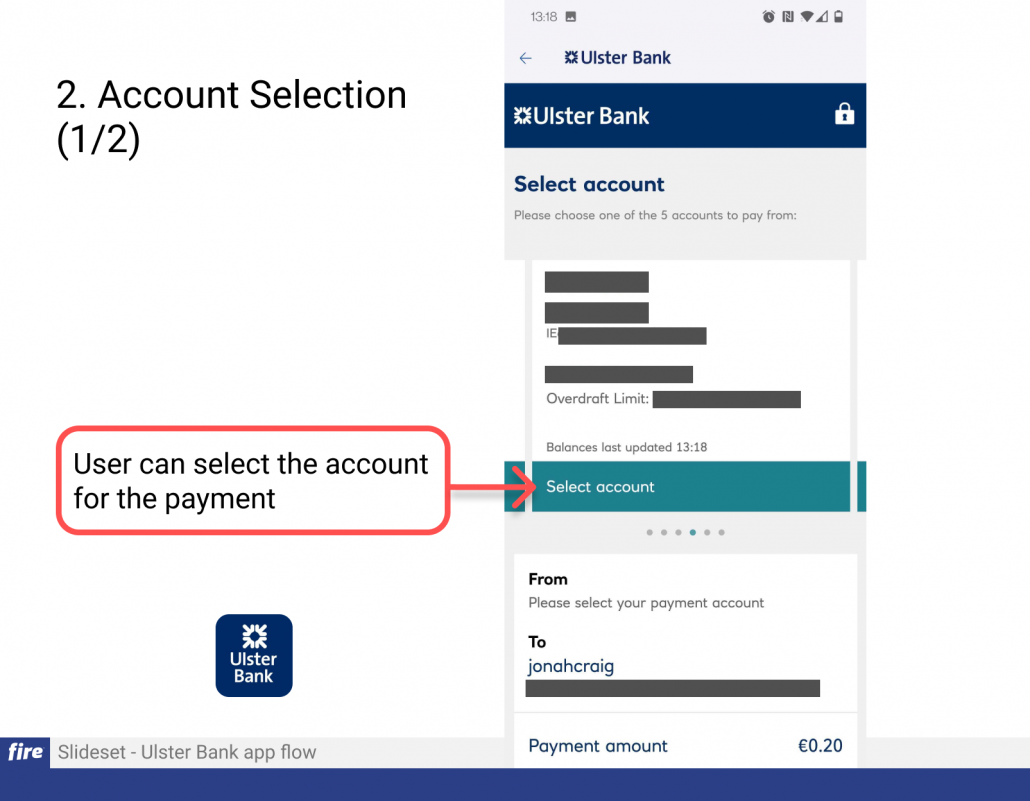

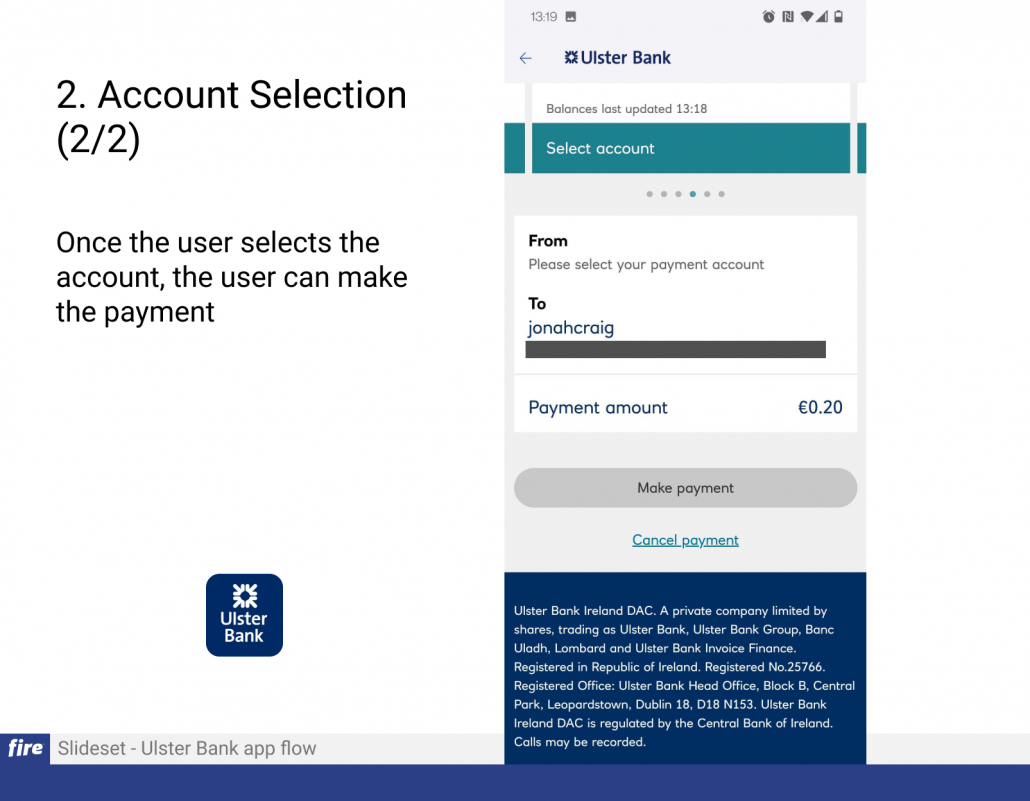

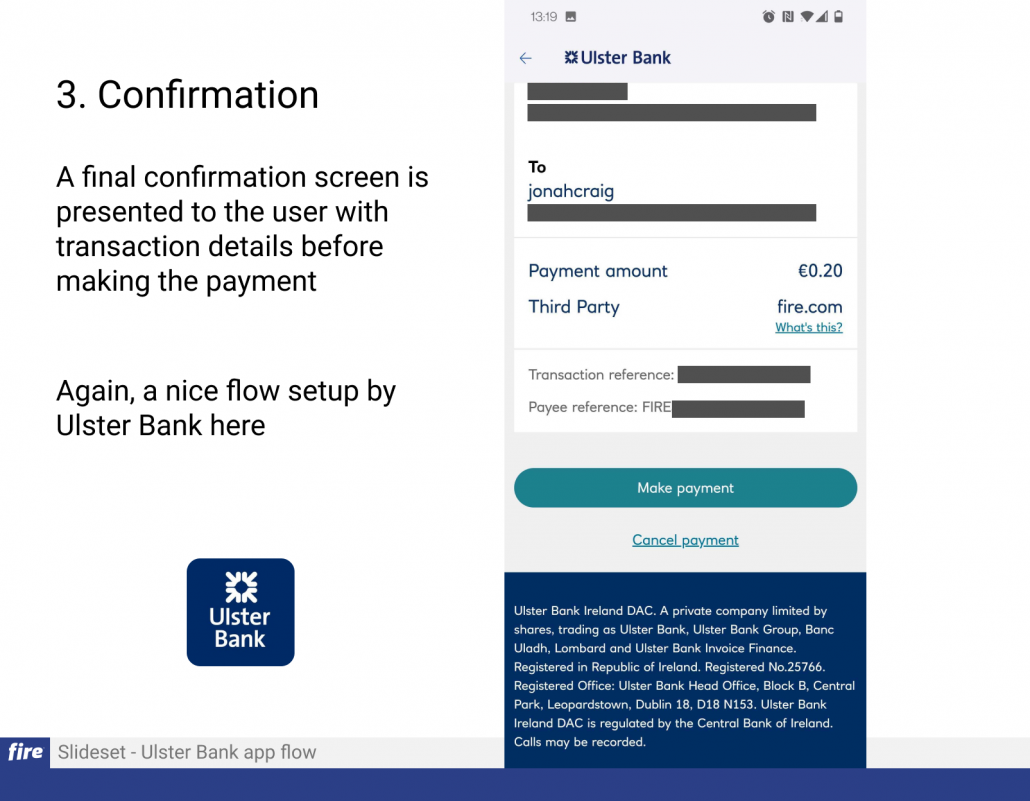

In this blog, I’ve outlined the mobile payment flows of the core banks here in Ireland (as of July 2021). In the below slides, we will journey through each of them. The objective of this blog is to highlight and compare the user experience.

With some recent updates we’ve seen with respect to Irish online banking apps, it has be said that the 2021 flows are vastly improved to what we saw in 2020.

Try out the below banking flows for yourself!